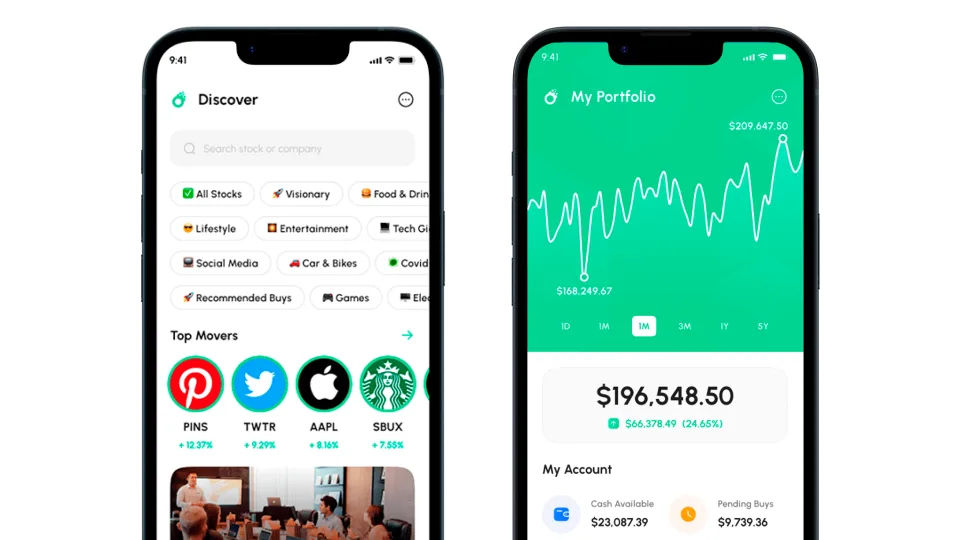

In the realm of stock market, where precision and timeliness are key, Traidy is on a mission to enhance the investor experience with AI-driven insights. However, when market predictions go awry or investment strategies don’t pan out as expected, traders often find themselves grappling with complex data analysis to make informed decisions.

Injecting AI into stock market isn’t new. Companies have been exploring various ways to leverage technology to enhance trading strategies. However, Traidy’s approach stands out by leveraging Large Language Models (LLMs), popularized by ChatGPT, to interpret social interactions and market trends. Traditional stock market platforms, while efficient, often lack the nuanced understanding of market dynamics that can lead to missed opportunities or misinterpretation of data.

“During the pandemic, we witnessed a significant shift in the stock market landscape, primarily fueled by the rise of social platforms like WallStreetBets. This movement has not only amplified the role of retail investors but also flooded the market with a deluge of trading signals and information” said Aleksander Bashyskyi, CEO of Traidy. “Keeping up with this barrage of data is a herculean task for any individual investor. This is where Traidy steps in. Our AI-driven platform is designed to analyze and interpret this vast array of information, making it manageable and actionable for our users. We’re not just simplifying stock market investing; we’re empowering investors with the right tools to navigate through the noise of social trading platforms.”